Enrollment with Zelle® through Wells Fargo Online® or Wells Fargo Business Online® is required. Transactions between enrolled users typically occur in minutes. For your protection, Zelle® should only be used for sending money to friends, family, or others you trust.

Neither Wells Fargo nor Zelle® offers a protection program for authorized payments made with Zelle®. The Request feature within Zelle® is only available through Wells Fargo using a smartphone. In order to send payment requests to a U.S. mobile number, the mobile number must already be enrolled with Zelle®. To send or receive money with a small business, both parties must be enrolled with Zelle® directly through their financial institution's online or mobile banking experience. For more information, view the Zelle® Transfer Service Addendum to the Wells Fargo Online Access Agreement. When you provide a phone number to us, you agree that you own or are authorized to provide the telephone number to us.

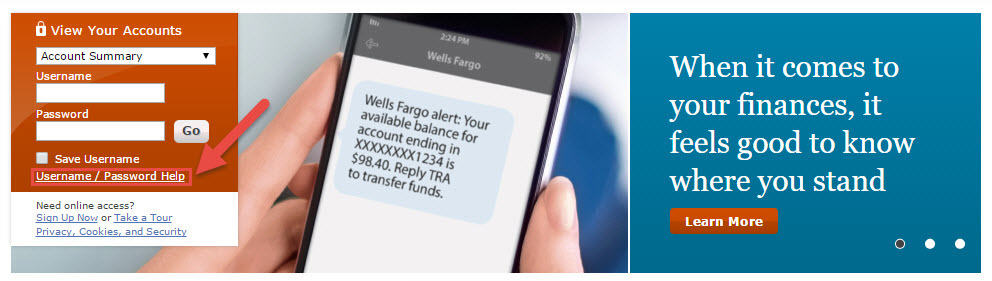

To help protect your account security, Wells Fargo does not support SMS or MMS functionality for recognized VoIP, prepaid or landline phone numbers. In order to receive text messages from Wells Fargo, such as one-time passcodes or suspicious activity alerts, an eligible phone number and mobile device are required. Turning off your card is not a replacement for reporting your card lost or stolen. Contact us immediately if you believe that unauthorized transactions have been made. Turning your card off will not stop card transactions presented as recurring transactions or the posting of refunds, reversals, or credit adjustments to your account. Any digital card numbers linked to the card will also be turned off.

For debit cards, turning off your card will not stop transactions using other cards linked to your deposit account. For credit cards, turning off your card will turn off all cards associated with your credit card account. Availability may be affected by your mobile carrier's coverage area. Enrollment in Wells Fargo Online® Wires is required, and terms and conditions apply. Applicable outgoing or incoming wire transfer service fees apply, unless waived by the terms of your account.

Wells Fargo Online Wires are unavailable through a tablet device using the Wells Fargo Mobile® app. To send a wire, sign on at wellsfargo.com via your tablet or desktop computer, or sign on to the Wells Fargo Mobile app using your smartphone. For more information, view the Wells Fargo Wire Transfers Terms and Conditions. Wells Fargo also touts the use of your Way2Save account as a method of overdraft protection for customers who also have checking accounts. If you sign up for this optional service, Wells Fargo will transfer money from your Way2Save account into your checking account to cover an overdraft. However, this service doesn't prevent you from being charged a $12.50 overdraft fee once per business day.

The fee can be avoided if a covering transfer or deposit is made on the same business day. This account carries a $12 monthly service fee, which is waived by maintaining a $3,500 minimum daily balance each statement period. Platinum Savings account holders can receive a complimentary debit card, a perk that isn't common with savings accounts. Other software companies realized that there was potential to become the platform of choice for customers to do their banking. Prodigy, owned by Sears, offered a secure network that Wells Fargo and other banks and businesses allowed to access their own company computer systems.

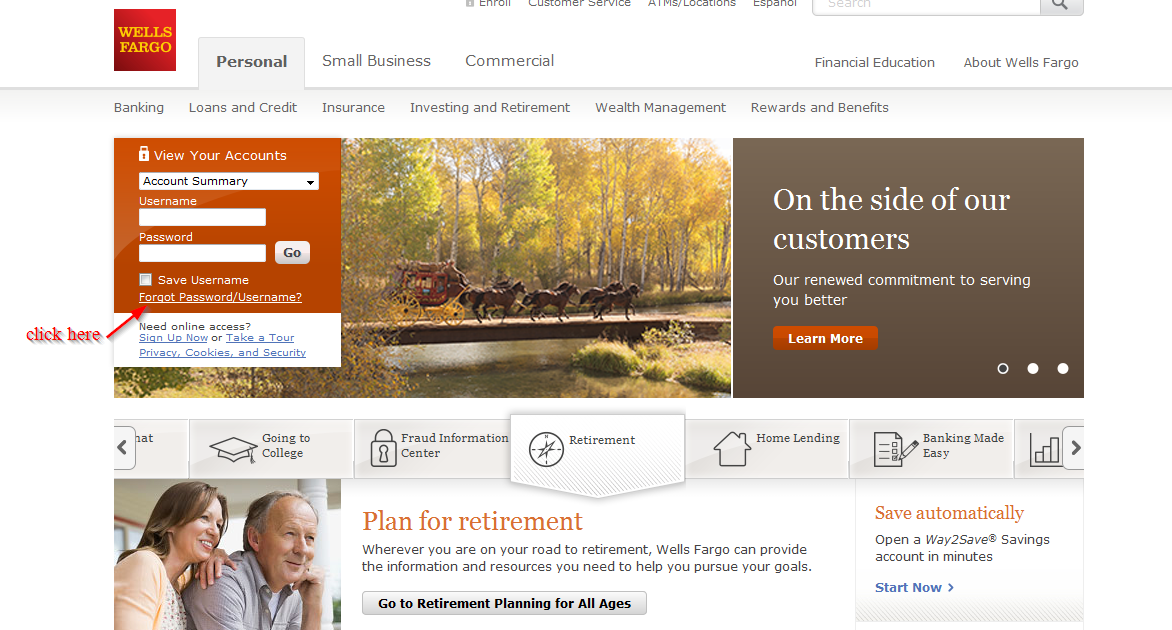

Customers using the Prodigy service were able to access their bank accounts from the comfort of home for the first time. They could also transfer money, read news, play games, and even order groceries online using the community bulletin feature. Customers had to buy a software package and pay a monthly fee for their software's subscription in addition to any fees charged by their bank. Customers had to use floppy disks and dial up modems to connect to their information. Wells Fargo started offering online account access through Prodigy in 1989, and by the mid-1990s it found that only about 10,000 of its 3.5 million customers used the service.

Wells Fargo may automatically send you certain alert messages via email, text message, push notification, and/or by other means, including to your mobile device. These messages may include notifications about potential fraud on your accounts, debit card or credit card, recent account activity, or changes to your online profile. You can opt not to receive push notifications by turning off push notifications on your Wells Fargo Mobile app. A Funding Account may not be used to pay any part of the balance you owe on that Funding Account.

Eligible Accounts that require two or more signatures or authorizations to withdraw or transfer funds may not be used as a Funding Account. A Funding Account must remain linked to the Service in order to use the Funding Account for current, future and automatic Bill Pay payments. Mobile deposit is only available through the Wells Fargo Mobile® app. See Wells Fargo's Online Access Agreement for other terms, conditions, and limitations. Note that these liability rules are established by Regulation E, which implements the federal Electronic Fund Transfer Act and do not apply to business accounts.

Our account agreements regarding unauthorized debit card, ATM Card, Wells Fargo EasyPay®, and consumer and business credit card transactions may give you more protection, provided you report the transactions promptly. Please see the agreement you received with your ATM, debit card, Wells Fargo EasyPay, or consumer and business credit cards, and the Eligible Account agreement. Availability may be affected by your mobile carrier's coverage area. See Wells Fargo's Online Access Agreementfor other terms, conditions, and limitations. In addition, Wells Fargo automatically waives the monthly fee for account holders under the age of 24.

Set up is required for transfers to other U.S. financial institutions, and may take 3–5 days. Customers should refer to their other U.S. financial institutions for information about any potential transfer fees charged by those institutions. See Wells Fargo's Online Access Agreement for more information. By texting IPH or AND to 93557, you agree to receive a one-time text message from Wells Fargo with a link to download the Wells Fargo Mobile® app.

Please refer to the Supported Browsers and Operating Systems page for mobile OS details. Wells Fargo does not charge a fee to send or receive money with Zelle. However, when using Zelle on a mobile device, your mobile carrier's message and data rates may apply. You'll know that your deposit is available when the amount appears online in the available balance of the Eligible Account you selected when you submitted your mobile deposit.

This balance may not reflect all of your transactions, such as checks you have written or debit card transactions that have been approved but not yet submitted for payment by the merchant. Charges may apply, however, for the Wells Fargo Same Day Payments ServiceSM. Please refer to our fees page for fees associated with our online services. Account fees (e.g. monthly service, overdraft) may also apply to your account that you make Bill Pay payments from.

Please refer to the Account Agreement, including the Fee and Information Schedule, applicable to your account. Customers looking for a well-established and well-rounded financial institution may do well with Wells Fargo. Not only does this bank possess a large geographic footprint, but it also has every type of account, product and service you may need — a true one-stop banking shop.

Add in the fact that you can enjoy some relationship bonuses for linking multiple accounts or products under the Wells Fargo umbrella and this institution is a clear winner for anyone who values efficiency and streamlined banking experience. That said, Wells Fargo has not yet earned back the public's trust after the revelations from 2016 to 2018, of a series of systemic fraudulent practices that victimized its own clients for nearly two decades. While it is relatively easy to avoid the monthly fee, make sure you're aware of the other charges you may face, including a $2.50 out-of-network ATM fee and a $35 overdraft fee if you overdraw your account. If you sign up for Overdraft Protection with a linked savings account, you can avoid the painful $35 fee, but you will still have to pony up a $12.50 transfer fee when the money moves from savings to checking.

Another savings encouragement is the Save As You Go® transfer, which moves $1 from your Wells Fargo checking account to your Way2Save account with each qualifying transaction. These transactions include any non-recurring debit card purchases and any time you pay a bill using the Wells Fargo online bill pay option. If you take the time to waive the paper statement fees by switching to online statements, Wells Fargo's monthly fees are slightly better than those at other major banks.

However, the real advantage at this bank comes with the large variety of options. For instance, neither Chase nor Bank of America —Wells Fargo's two closest competitors —carry any options specifically marketed to customers whose credit or banking histories prevent them from getting approved for accounts elsewhere. The Wells Fargo Opportunity Checking Account gives such "toxic" bank customers an opportunity to get back into the mainstream banking system.

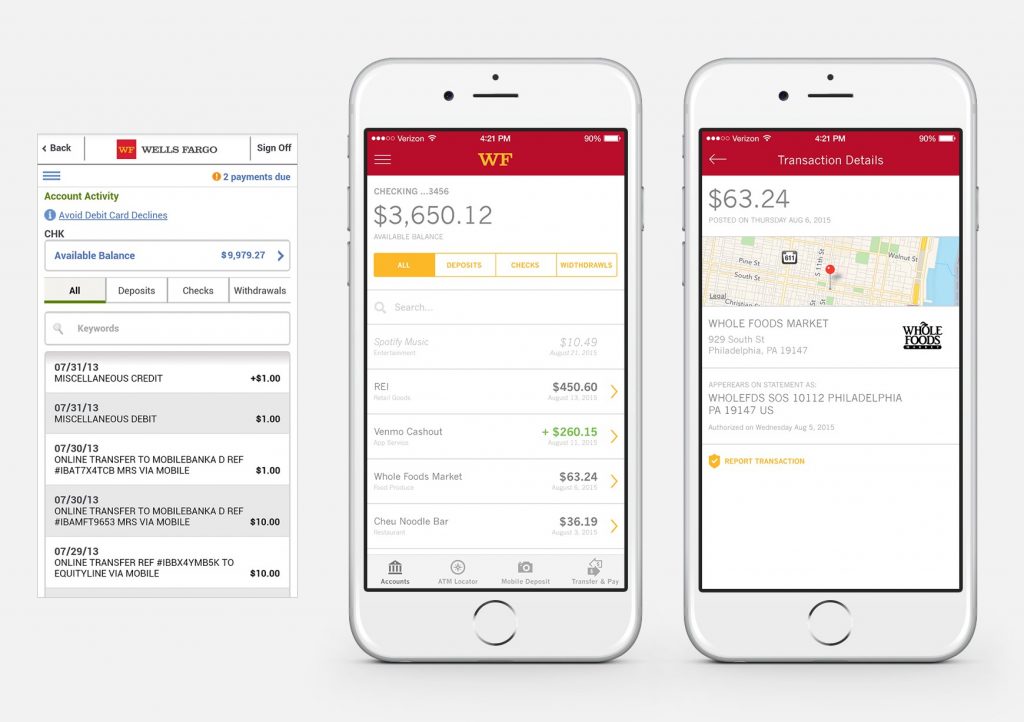

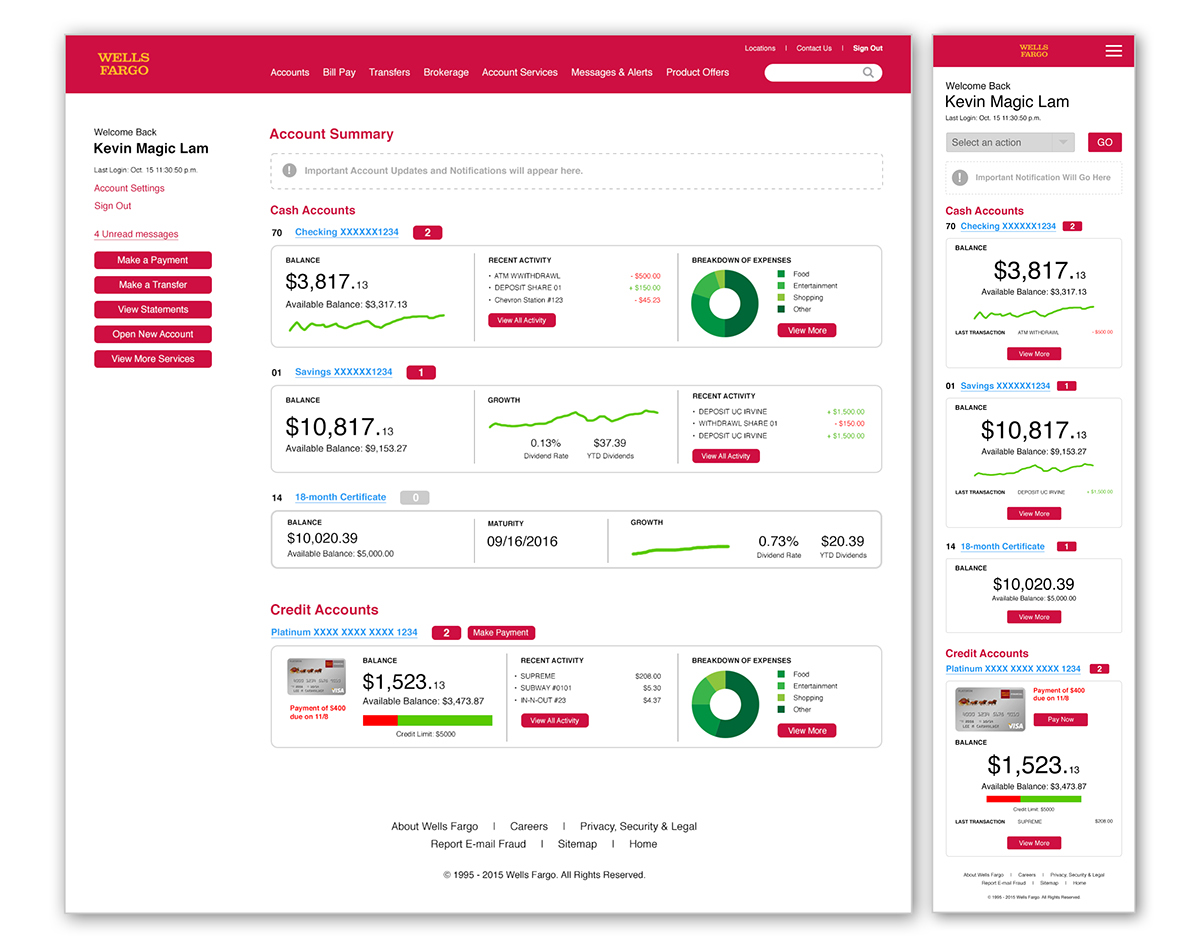

Wells Fargo offers several other products and services outside of its personal deposit accounts. The bank offers many credit cards, including several popular rewards and cash back credit cards. With our mobile app, you can quickly sign on using biometric authentication,, deposit checks, pay bills, transfer funds, set up alerts to help monitor your activity, and more. For deposit accounts, you may view online images of the individual checks posted to your account.

If you currently receive an account statement with check images in paper format, once you choose online-only statements and documents, you will no longer receive the check images as part of the statement. You can ask us to mail a photocopy of a cancelled check to you . The provisions in this Section apply only to transfers to and/or from business accounts. You agree that the password security described in the Agreement and in this Section sets forth security procedures for fund transfers that are commercially reasonable. For most accounts, Guest Users have online access to the accounts you designate, including your account balance, activity, and statements by accessing your accounts using a username and password, which you must create and manage for them.

You can transfer money between your Wells Fargo checking and savings accounts and accounts you may have at other U.S. financial institutions. Wells Fargo gives you flexibility, convenience, and control to transfer funds where and when you need it. Simply sign on to Wells Fargo Online to access transfers, and click Add Non-Wells Fargo Accounts to get started.

Only select devices are eligible to enable sign-on with facial recognition. If you have family members who look like you, we recommend using your username and password instead of facial recognition to sign on. Wells Fargo Online comes with the ability to receive and view statements for most of your accounts online. Simply enroll to set up a username and password to access your personal and business accounts online.

You can check account balances, pay bills, or transfer funds; quickly find an ATM or branch location; receive and send money with people you know and trust using Zelle®; and receive alerts to track your account activity. In most cases, deposited stimulus funds are available right away, up to $2500. Immediate availability of funds is subject to change at any time, without advance notice. Check your ATM receipt or mobile deposit confirmation screen to see when you will have access to your deposit.

Capital One also has a 360 Performance Savings Account that boasts a 0.4% APY. These rates are far higher than what you can earn with any Wells Fargo product, at any balance. If you're willing to give up banking in person, Capital One's bank accounts may present better value than Wells Fargo. Location aside, Chase tends to fall behind Wells Fargo in the variety of checking and savings services it offers.

Wells Fargo offers several investment services, including self-directed and automated investing. Wells Fargo provides IRAs, mutual funds, rollover accounts and college savings accounts for retirement and education planning. "We know the importance of the stimulus funds to our customers, and Wells Fargo is making the stimulus funds available immediately when they are made available to us," Wells Fargo said in a statement on Tuesday.

Available balance is the most current record we have about the funds that are available for your use or withdrawal. It includes all deposits and withdrawals that have been posted to your account, then adjusts for any holds on recent deposits and any pending transactions that are known to the bank. Our overdraft fee for Business and Consumer checking accounts is $35 per item ; our fee for returning items for non-sufficient funds is $35 per item.

We charge no more than three overdraft and/or non-sufficient funds fees per business day for Consumer accounts and eight per business day for Business accounts. Overdraft and/or non-sufficient funds fees are not applicable to Clear Access Banking℠ accounts. The overdraft and/or non-sufficient funds fee for Wells Fargo Teen Checking℠ accounts is $15 per item and we will charge no more than two fees per business day. Online statements and documents are available for certain Eligible Accounts or Online Financial Services if you have completed enrollment in the Service and provided us with a valid email address.

Once enrolled, we will send you an email notice (as described in Section 9) notifying you when your statement or document is available on the Website. To ensure that you continue to receive such email notifications, you must notify us of any changes or updates to your email address. We may revoke your online-only statement and document option and change your delivery preference to U.S. Many account documents - including statements, tax documents, and legal notices - can be delivered online for certain Eligible Accounts and Online Financial Services.

You have the option to view, save, or print PDF versions of your account documents from the Website via desktop, tablet, or mobile device. To complete your fund transfer we may utilize ACH transfers, which will result in a debit to one of your Accounts and a credit to another of your Accounts. All Wells Fargo ACH transfers go through a Wells Fargo transfer account. For ACH debit entries , Wells Fargo Bank typically holds funds for 3-4 Business Days to make sure that the item will not be returned unpaid before we will credit your Account.

The hold times may vary for brokerage accounts at a Wells Fargo affiliated broker-dealer. If the ACH transaction is returned for any reason and the payment has been credited to your Account, you authorize us to debit your Account, in whole or in part, for the amount of the returned item and for any returned item fee. The provisions in this Section apply only to bill payments from Business accounts. You agree that the security procedures required by us under this Agreement set forth security procedures for electronic funds transfer that are commercially reasonable. The provisions in this Section apply only to electronic fund transfers that debit or credit a Consumer's checking, savings, or other asset account and are subject to Regulation E, which implements the federal Electronic Fund Transfer Act.

You can find the terms and conditions that apply to EFTs that debit or credit a brokerage account in your brokerage account agreement, not this Agreement. If you store multiple fingerprints on your device, including those of additional persons, those persons will also be able to access your Wells Fargo Mobile® app via fingerprint when fingerprint is enabled. As the bank's premium checking account, Portfolio by Wells Fargo offers customers a number of major perks.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.